House of Companies equips businesses with vital knowledge and tools to efficiently handle international VAT compliance in Dubai. Whether you're a homegrown start-up venturing into the UAE market for the first time, or a multinational corporation exploring opportunities in Dubai, understanding the necessity and impact of VAT registration, and how to simplify the VAT registration procedure, is crucial.

VAT can be complicated, especially when you trade in Dubai and the UAE. We can help you navigate the UAE's VAT system, apply for a Tax Registration Number (TRN), and understand the reverse charge mechanism for certain transactions.

At House of Companies, we strive to make the VAT registration and filing process in Dubai as smooth and hassle-free as possible for global entrepreneurs like you. We offer two additional services that can further simplify your journey:

If you have specific questions or concerns about your VAT situation in Dubai, our team of VAT experts can provide you with a customized Advisory Report. This report will offer insights and recommendations tailored to your business, helping you make informed decisions and optimize your VAT compliance strategy in the UAE.

Enter our innovative Entity Management service, a game-changing platform designed to streamline and simplify the VAT registration process in Dubai. This comprehensive business portal provides a one-stop solution for companies looking to expand their operations in the UAE. By leveraging technology and a team of VAT experts familiar with Dubai's regulations, our service offers a seamless, user-friendly experience that breaks down the barriers of traditional VAT registration in the emirate.

Our Entity Management Service provides expert guidance throughout the VAT registration process in Dubai. Our team of VAT specialists is available to answer any questions and provide advice, ensuring that businesses are fully compliant with VAT laws in the UAE. This expert support helps mitigate the risk of penalties and non-compliance, giving companies peace of mind as they expand their operations in Dubai.

"The fixed fee structure made budgeting for VAT registration easy. I appreciated the transparency and the fact that there were no hidden costs. I feel secure knowing my VAT needs are in good hands."

Mohammed A

Mohammed A"Getting my VAT ID was easier than I ever imagined! The experts were quick to respond to my inquiries, making the process efficient and stress-free. I highly recommend their services!"

Zayed H

Zayed H"The ability to apply for VAT ID and file taxes from one location has transformed how I manage my business. Their platform is user-friendly, and the support team is always ready to assist. A game changer!"

Omar T

Omar T

Learn More →

Learn More →

Learn More →

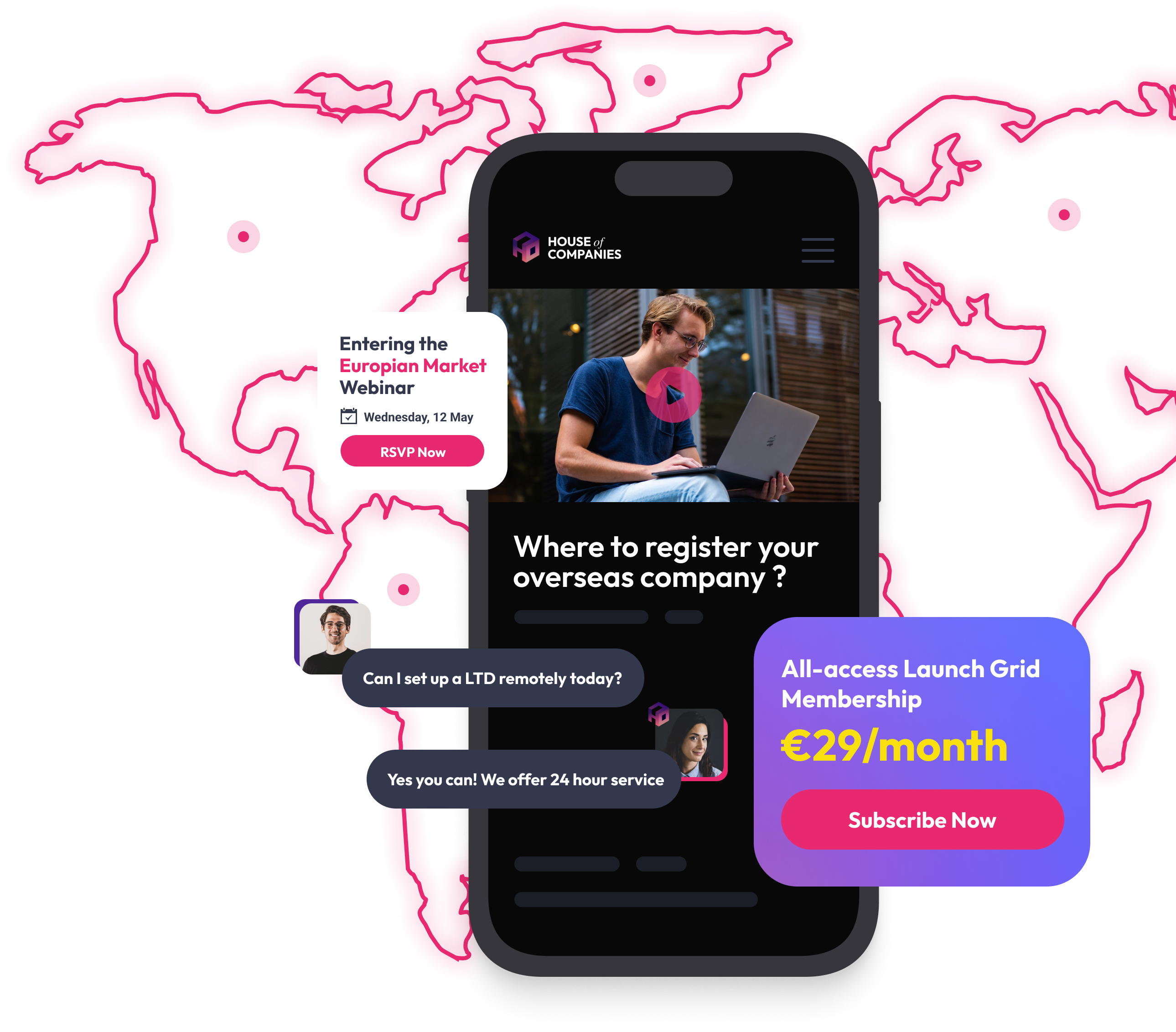

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!